Digitized | Monthly (4/17/25)

crypto, curated by collab+currency

gm folks.

Welcome back to another edition of Digitized Monthly. We’ve done our best to separate the signal from the noise, providing you with the top news, product updates, and research across the crypto landscape.

Thanks for being here. Hope you enjoy the read.

Until next month,

Hester Peirce / New Crypto Guidance — The SEC issued guidance on crypto asset securities, outlining disclosure expectations for business details, risks, and technical specs. The goal is to clarify registration rules and improve transparency — more

FDIC / Clarifies Process for Banks — The FDIC has issued new guidance allowing FDIC-supervised banks to engage in crypto-related activities without prior approval, provided risks are properly managed. This move replaces prior guidance and signals a shift toward clearer, more supportive regulation — more

Tether / Clarifies US Stablecoin Strategy — Tether CEO Paolo Ardoino says the firm may launch a new U.S.-compliant stablecoin if USDT is pushed out by regulation. While Tether focuses on emerging markets, it’s exploring ways to stay active in the U.S. and Europe amid tightening stablecoin laws — more

Tether / Investment in Fizen — Tether has invested in fintech firm Fizen to expand stablecoin adoption and self-custody solutions. The partnership aims to simplify crypto payments for users and merchants — more

404-GEN (🤝) / Integrates with Unity — 404-GEN has integrated its decentralized 3D model platform with Unity, letting users generate models directly from Bittensor (🤝) in a Unity environment. Prompts are sent to miners who create competing 3D models, with the best selected algorithmically — more

Circle / Files for IPO — Circle, issuer of the USDC stablecoin, has officially filed for an IPO with the SEC, enlisting JPMorgan and Citi as underwriters. This marks a renewed push after previous delays, amid growing U.S. support for stablecoin regulation under the Trump administration — more

BlackRock / Expands Money Market to Solana — BlackRock has expanded its tokenized money market fund, BUIDL, to Solana via a partnership with Securitize. Now live on seven blockchains, BUIDL has reached ~ $1.7B in assets as BlackRock pushes deeper into on-chain finance and asset tokenization — more

Blackbird / $50M Raised — Blackbird, a blockchain-based payment-loyalty app for restaurants, raises round led by Spark Capital, with participation also from Coinbase Ventures, Amex Ventures, and Andreessen Horowitz. The startup has raised $85M to date — more

Crossmint / $24M Raised — Crossmint, an “all-in-one platform for companies and agents - including wallets, payments, tokenization, and more”, raises round led by Ribbit Capital, with participation from Franklin Templeton, NYCA, First Round, Lightspeed Faction, HF0, and others — more

Privy / $15M Raised — Privy, a crypto wallet infra provider, raises round led by Ribbit Capital, with participation from Sequoia Capital, Paradigm, BlueYard and Coinbase — more

Pluralis / $7.6M Raised — Pluralis, a startup working to “make true open source AI a reality”, raises seed round co-led by Union Square Ventures and CoinFund, with participation from Variant, Topology, Bodhi Ventures, and others — more

Meanwhile / $40M Raised — Meanwhile, a Bitcoin life insurance company, raises Series A co-led by Framework Ventures and Fulgur Ventures — more

Rain / $24.5M Raised — Rain, a blockchain-based card issuing and stablecoin interoperability platform, raises round led by Norwest, with participation from Galaxy, CompSecure, Coinbase, Lightspeed, Canonical, and others — more

Octane / $6.75M Raised — Octane, an AI-powered security platform focused on crypto, raises round co-led by Archetype and Winklevoss Capital, with participation from Gemini Frontier Fund, Circle, Druid Ventures, Duke Capital Partners, and others — more

P2P / $2M Raised — P2P, a crypto-to-fiat alternative using a network of middlemen to move payments between financial ecosystems, raises round with participation from Multicoin and Coinbase Ventures — more

Codex / $16M Raised — Codex, a startup building an integrated stablecoin infrastructure, raises round from Dragonfly, Circle, Coinabse, Cumberland, and others — more

Maven 11 / $107M Raised — Maven 11, a European crypto venture capital firm, raises its third fund at $107M — more

Oro Gold / $1.5M Raised — Oro, a project aiming to upgrade gold’s functionality from a store of value to a dynamic, yield-generating, composable financial asset, raises pre-seed led by 468 Capital, with participation from Fasset, Dead King Ventures, and others — more

Chronicle / $12M Raised — Chronicle, a crypto oracle network, raises seed round led by Strobe, with participation from Galaxy, Brevan Howard Digital, Tioga, and others — more

Uranium Digital / $6.1M Raised — Uranium Digital, a startup building an institutional-grade spot uranium trading platform, raises round led by Framework, with participation from Karatage, Mirana, Knollwood, and others — more

Walrus Foundation / $140M Raised — Walrus Foundation, the organization dedicated to the promotion and growth of a decentralized storage platform built on Sui, raises private token sale led by Standard Crypto, with participation from a16z crypto, Electric Capital, Creditcoin, Lvna Capital, Protagonist, Franklin Templeton Digital Assets, and others — more

Auradine / $153M Raised — Auradine, a bitcoin miner manufacturer, raises Series C led by StepStone Group, with participation from Maverick Silicon, Premji Invest, Samsung Catalyst Fund, Qualcomm Ventures, Mayfield, MARA Holdings, and others — more

Oro / $6M Raised — Oro, a startup building a decentralized intelligence platform to unlock high-quality private data, raises seed round co-led by a16z crypto and Delphi Ventures, with participation from Near, Orange DAO, and others — more

Kiran / Follow The Money — “Introducing Perdiem (🤝), and why transactions will power the information networks of the future” — more

Dynamic TAO (🤝) - 1 Month Review / Seth Bloomberg — “It’s been ~1 month since the launch of Dynamic TAO. I wanted to share (1) some data I look at frequently and give some thoughts on how I interpret the numbers, and (2) give some general thoughts on how the first month has gone and where I see some opportunities.” — more

Communication-Efficient Language Model Training Scales Reliably and Robustly: Scaling Laws for DiLoCo / Google — “We just put out a key step for making distributed training work at larger and larger models: Scaling Laws for DiLoCo. TL;DR: We can do LLM training across datacenters in a way that scales incredibly well to larger and larger models!” — more

The Value of Open Source Software / Manuel Hoffmann, Frank Nagle, Yanuo Zhou — “Great research on open-source by Harvard. 1) $4.15B invested in open-source generates $8.8T of value for companies (aka $1 invested in open-source = $2,000 of value created). 2) Companies would need to spend 3.5 times more on software than they currently do if OSS did not exist.” — more

Programmable Asset Ledgers / Robbie Peterson — “Some emerging technology enables a structural advantage -> a small subset of businesses adopt the technology to improve their margins -> incumbents either follow suit to remain competitive or they lose market share to more nimble adopters -> the adoption of the new technology becomes table stakes as capitalism naturally selects the winners.” — more

The State of Crypto Lending / Zack Pokorny — “This report explores the onchain and offchain cryptocurrency lending markets. It is divided into two sections: the first offers a history of the crypto lending market, the players in it, its historical size (onchain and offchain), and some of the pivotal moments in the sector.” — more

Stablecoins: Payments without intermediaries / Chris Dixon — “The internet made information free and global. So why is it still so hard — and expensive — to move money?” — more

Digital Assets: De-dollarization Moves Bitcoin Towards Monetary Role / VanEck — “China and Russia have reportedly begun settling some energy transactions in Bitcoin and other digital assets. Bolivia has announced plans to import electricity using crypto. And French energy utility EDF is exploring whether it can mine Bitcoin with surplus electricity currently exported to Germany. These are early signs that Bitcoin is evolving from a speculative asset into a functional monetary tool—particularly in economies looking to bypass the dollar and reduce exposure to U.S.-led financial systems.” — more

Unpacking decentralized training / Knower — “My attempt at highlighting the necessity of training LLMs in a distributed / decentralized manner, explaining a web of topics, and articulating the potential synergies between crypto + AI.” — more

Crashing the Car of Pax Americana / Ben Hunt — “I believe there have been three great pillars of investing success over the past 20+ years: US home country bias, US tech bias, and US dollar bias. I believe that all three of these are now melting icebergs, with enough mass to melt for a decade or more.“ — more

CTZ and the Parametric Product Stack / ChrisF — “A Product Development Model for Token-Incentivized Compute” — more

Paradigm Shifts / Dom Cooke — “Inside one of crypto’s most trusted institutions with Co-founder and Managing Partner Matt Huang” — more

AI 2027 / Daniel Kokotajlo, Scott Alexander, Thomas Larsen, Eli Lifland, Romeo Dean — “We predict that the impact of superhuman AI over the next decade will be enormous, exceeding that of the Industrial Revolution.” — more

The World's RL Gym / Sam Lehman — “What the RL renaissance means for decentralized AI” — more

Agents as NFTs / Daniel Barabander — “Agents as NFTs unlocks a net-new design space in software I’m excited to see play out.” — more

Unleashing onchain interest is a win-win / Brian Armstrong — “TL;DR U.S. stablecoin legislation should allow consumers to earn interest on stablecoins. The government shouldn't put its thumb on the scale to benefit one industry over another. Banks and crypto companies alike should both be allowed to, and incentivized to, share interest with consumers. This is consistent with a free market approach.” — more

The case against conversational interfaces / Julian — “Conversational interfaces are a bit of a meme. Every couple of years a shiny new AI development emerges and people in tech go “This is it! The next computing paradigm is here! We’ll only use natural language going forward!”. But then nothing actually changes and we continue using computers the way we always have, until the debate resurfaces a few years later.” — more

The DeSci value chain in 2025 / Patrick Mayr — “I wrote a post last year laying out the DeSci value chain as I saw it. At the time I had broken it down into 3 core components: funding, research and publishing. I’d now add a fourth component: commercialization.” — more

AI × Crypto Investment Thesis 2025 / cyber Fund — “AI represents the world's largest market because it encompasses all of problem-solving. The resulting AI market landscape is enormous. Recognizing that it's impossible to invest everywhere, we specifically target the intersection of Crypto and AI.” — more

TradFi Tomorrow: DeFi and the Rise of Extensible Finance / Paradigm — “We surveyed 300 TradFi professionals—spanning institutions, roles, and regions—and the verdict was near-unanimous: today’s financial system is bogged down by inefficiencies that stifle economic growth and drain resources.” — more

Wayfinder (🤝) / PROMPT TGE — Wayfinder, a collection of AI agents that can seamlessly transact across multiple chains, execute smart contract functions, and complete algorithmic trades, launched its PROMPT token on April 10th — more

Prime Intellect (🤝) / Introducing INTELLECT-2 — Prime Intellect has launched INTELLECT-2, the first globally distributed reinforcement learning run for a 32B parameter model. Built with tools like prime-RL, TOPLOC, and GENESYS, it enables permissionless compute contributions and verifiable decentralized training — more

Podcast / Jeffrey Quesnelle on Nous Research (🤝), large language models, and the human mind — “Here is my conversation with Jeffrey Quesnell, cofounder of Nous Research. We talked about the history of neural networks, modern model architectures, parallels with the human mind, and how we each think about finding meaning in this new world.” — more

Colosseum (🤝) / Creates Echo Group — Colosseum has launched an Echo group to support crypto founders building on Solana through its accelerator. The initiative’s aim is to connect Echo’s angels with top Solana startups — more

Tachyon / Announces TachyonX 2025 — TachyonX is offering $250K investments to founders building at the intersection of AI and crypto. The program includes mentorship, 1:1 advising, and support from Linea and Consensys, with a focus on AI infra, intent systems, and decentralized data tools — more

Subs / Tokenized Internet Subforums — Subs is a Solana app for tokenized internet subforums, where each sub has its own coin, AI moderator, and reward system. Members earn tokens for posting, while AI agents learn from shared content, creating domain-specific knowledge over time — more

Ethena / Introducing Converge — Converge, a new settlement network from Ethena and Securitize, aims to merge TradFi and DeFi using USDe, USDtb, and ENA. The EVM-compatible network will launch its mainnet in Q2 — more

Magic Eden / Acquires Slingshot — Magic Eden has acquired Slingshot to enable seamless, bridgeless cross-chain trading with a single universal account. The move aims to simplify token purchases across multiple blockchains — more

Emily Nicoll & 747 / Art Blocks (🤝): Pacific Spirit — “Pacific Spirit is the second studio album from Canadian electronic music artist 747, set to release on the Aquaregia label. Its acid-inflected dive into jungle breaks and dreamy atmospheres is extended through an accompanying generative art series. Token holders are invited to claim a complimentary vinyl record, featuring their cover, through the Aquaregia label website during the mint period.” April 25th — more

Sofia Crespo / Fellowship: Critically Extant — “Critically Extant is a project that explores just how little we know about the natural world by testing the limits of the data openly available to us in our digital lives. To achieve this, AI algorithms were trained on millions of open source images of nature and some ten thousand species.” May 22 — more

brody / Distributed Training Discussion with Ronan

Stepan / Squads Protocol (🤝) Stablecoin TVL Growth

Hype (🤝) / Limit Orders Enabled on Mobile App

Digitized / 100th Edition of Featured

Metaplex (🤝) / March Round Up

JupiterDAO / Acquires Drip Haus (🤝)

9dcc (🤝) / ABALLE Collection

Botto (🤝) DAO / New Period Utilizing p5.js

Digitized / Spotlight x B3 (🤝)

Peter / 1kx Announces Echo Group

stablecoin p / List of Yield Bearing Stablecoins

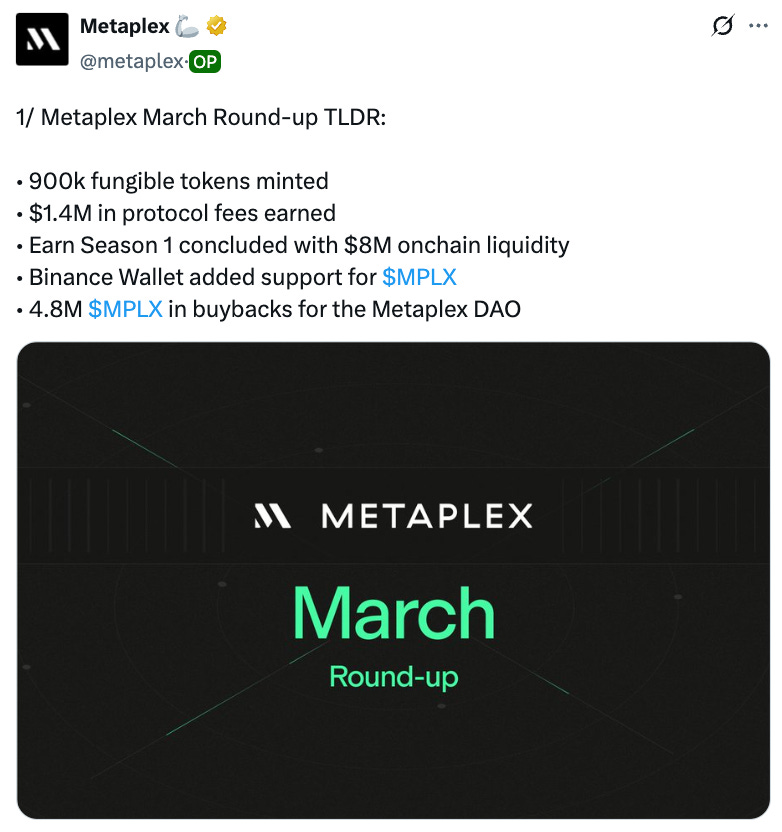

Logan Kilpatrick / Google’s Ironwood Release

Jason Rosenthal / Crypto Startup Accelerator Cohort

🤝 = Collab+Currency Portfolio Company

Curated by @Collab_Currency x @_cutbank

If you enjoyed this edition of Digitized, please subscribe below and follow @digitizedweekly on Twitter. Let’s Form Group.

Collab+Currency is an investor in companies labeled with the “🤝” emoji.

The information provided is for general informational purposes only and should not be construed as investment advice or a recommendation to buy, sell, or hold any particular asset or securities. Investing in digital assets, NFTs or cryptocurrency is highly speculative and volatile. Past performance is not indicative of future results. Investors should consult with their own financial, legal, and tax advisors before engaging in any investment strategy or taking any actions based on the information discussed. Any forward-looking statements are not guarantees of future performance and are subject to certain risks, uncertainties, and assumptions that are difficult to predict. While attempts have been made to verify the accuracy of the information provided, we cannot make any guarantees.