Digitized | Featured #96

Welcome to this week's edition of Featured, your weekly guide to the most interesting blockchain-based digital objects – across gaming, social, music, media, fashion, AI, immersive environments, and other consumer crypto categories.

This week, we turn the spotlight on ADIN, an AI-powered venture capital network that combines cutting-edge AI agents and a global investor community to transform how startups raise capital and how funds deploy it.

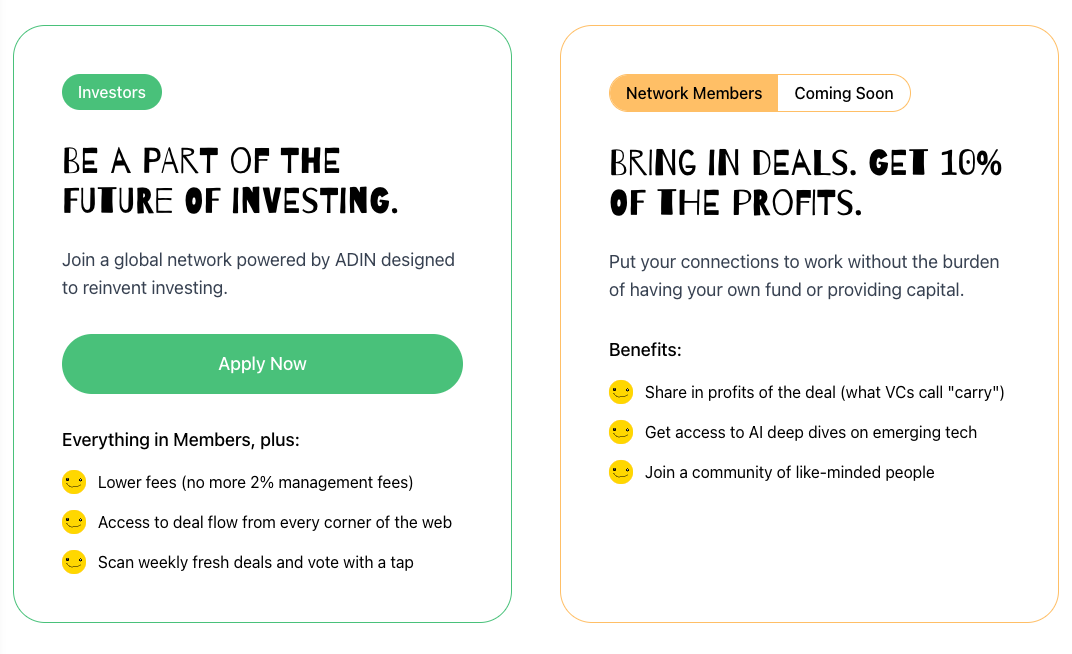

ADIN isn’t just another investment tool–it’s a network of AI agents designed to:

🙂 Perform superhuman diligence in minutes

🙂 Predict a company’s value with high accuracy

🙂 Vote on investment decisions

🙂 Recommend allocation sizes based on fund thesis & risk appetite

Read more about ADIN here.

While traditional VCs analyze ~300 deals a year, ADIN can evaluate thousands, surfacing opportunities that others miss.

Investors gain early access to breakthrough startups, and founders get faster, smarter capital that truly understands their business.

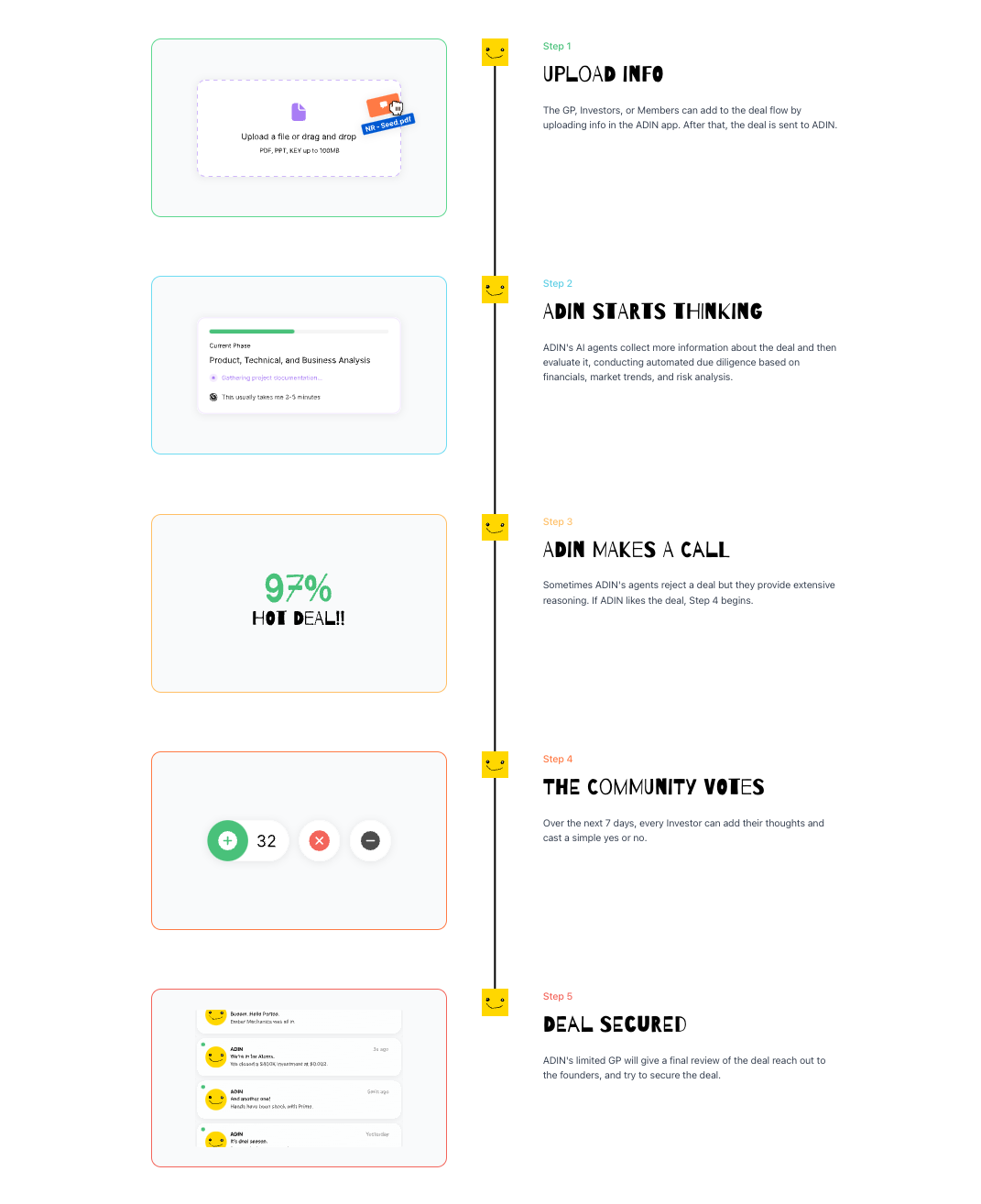

Here’s how ADIN works

1️⃣ Investors upload a deal into ADIN

2️⃣ AI agents gather & assess all available data

3️⃣ The system provides an in-depth diligence report

4️⃣ ADIN’s agents vote & recommend investment terms

5️⃣ The investor community reviews & finalizes the deal

ADIN’s diligence reports aim to be comprehensive–analyzing product, market size, financials, compliance risks, competitor landscapes, and more.

The system continuously updates as new data emerges, ensuring real-time insights.

ADIN is already live, running in the background of DAOs like The LAO, Punk Ventures DAO, Metropolis DAO, and others—helping them identify some of the most important projects in crypto and beyond.

Upcoming ADIN capabilities

📩 Direct deal sourcing via email

💬 Investment updates via chat messages

🌎 Scouring the internet for active raises

📊 Automated market reports

🤝 AI-powered founder due diligence

Initially, ADIN is focused on AI and blockchain investments, where its analytical strengths provide a competitive edge.

But its adaptable model can expand into biotech, robotics, and quantum computing as new opportunities arise.

Structurally, ADIN will operate as a decentralized investment vehicle, with Tribute Labs acting as a limited general partner. The goal? A fully autonomous investment network blending AI reasoning with human expertise.

This content is educational in nature and is not investment advice. Investing in DeFi and digital assets involves a high level of risk and should be undertaken only by individuals prepared to endure such risks.

If you enjoyed this edition of Featured, please subscribe below and follow @digitizedweekly on Twitter.

Collab+Currency may be an investor in the projects and/or products that appear in Featured.

Information regarding any company or investment in Featured should not be construed as an endorsement or recommendation of that company or investment for any purpose whatsoever, either for purposes of investment or otherwise. Any person receiving Featured or accessing our website is encouraged to consult with their own financial advisor, tax advisor and/or attorney before making any decision to invest.

The above material and content is educational in nature and should not be considered to be a recommendation to invest. Investing in digital assets, NFTs or cryptocurrency is highly speculative and volatile. Past performance is not indicative of future results.

ADIN